How AI's Dominance is Reshaping Valuation Dynamics Across Industries

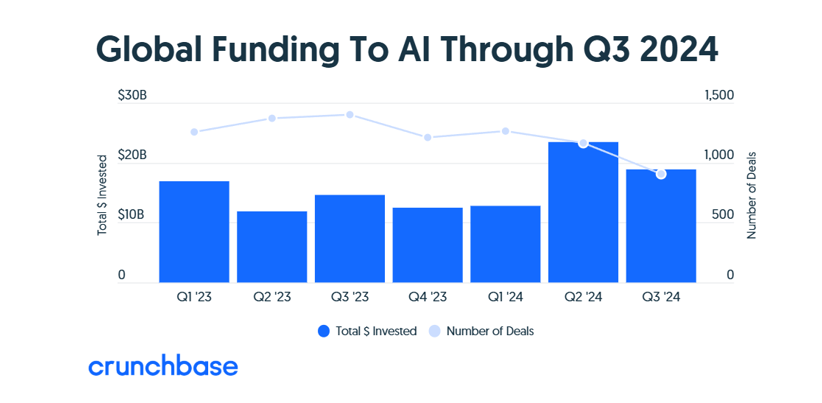

In 2024, AI has become the hottest area for investments, attracting over $24 billion in funding in just the second quarter. It’s stealing the spotlight from other sectors like fintech, consumer tech, and sustainability, which are seeing less funding. This doesn't imply that such areas are finished; rather, they may still contain hidden potential.

MARKET INSIGHTS

MD. Imran Hossain

5/7/20242 min read

In 2024, AI has become the hottest area for investments, attracting over $24 billion in funding in just the second quarter. It’s stealing the spotlight from other sectors like fintech, consumer tech, and sustainability, which are seeing less funding. This doesn't imply that such areas are finished; rather, they may still contain hidden potential. As everyone rushes toward AI, investors can look at these undervalued sectors and find great opportunities. It’s all about spotting where the market’s attention has shifted and acting wisely.

Between 2023 and 2024, VC funding saw ups and downs, heavily influenced by AI. In Q1 2023, global VC funding hit $65.7 billion, with AI startups grabbing a big slice. By Q2, AI funding made up 35% of all VC investments—the highest share ever recorded. However, in Q3 2023, total funding dropped to levels seen in 2016-2017, even though the average deal size grew, showing a focus on fewer but bigger deals. In 2024, AI stayed strong, with startups raising $12.2 billion in October alone, making up 38% of global venture funding that month. This highlights AI's growing impact on the VC world.

The boom in AI investments has caused funding in other sectors to drop, creating chances for investors to grab undervalued assets. Global startup funding rounds fell by 25.9% from 2023 to 2024, going from 48,881 to 36,203. Non-AI startups now face tougher competition for funding. Sectors like sustainability and niche SaaS are seeing lower valuations, which could offer great long-term returns as they adapt to new regulations and changing consumer needs.

Non-AI companies have a chance to strengthen their finances and improve efficiency by adopting strategies like mergers and acquisitions (M&A), integrating AI into their processes, and using remote work models. These steps help them perform better and offer great value to investors willing to look beyond the AI hype. Strategic M&A can help businesses gain new technologies, enter new markets, and save costs by scaling operations. Adding AI to processes boosts efficiency by automating tasks, optimizing supply chains, and cutting costs. Remote work also reduces overhead, saving over $10,000 per employee while tapping into global talent. For investors, this is a great time to explore non-AI sectors that are ready for innovation and growth, with potential for big returns as these companies become smarter and more competitive.

In conclusion, while AI businesses dominate investments with high valuations fueled by their potential and hype, this focus leaves room for non-AI sectors to shine. Companies in these areas that boost efficiency, streamline operations, and show strong growth can become hidden gems for investors. By using strategies like mergers, adopting AI to improve processes, and cutting costs through remote work, non-AI businesses can deliver impressive results and attract attention. This shift creates a golden chance for investors to find high-performing non-AI companies and reap big rewards, paving the way for a more balanced and diverse investment future.

Ready to Elevate Your Business?

Partner with IH Capital & Research and Achieve Your Financial Goals.

Contact us

Schedule a Free Initial Consultation Now!

contact@ihcapitalresearch.com

+880-1777189733

© 2024. All rights reserved by IH Capital & Research